Summary

Morecambe FC's ownership carousel isn't just another lower-league drama. it's a highlighter that shines the light on everything broken about football governance. From phantom buyers to mysterious bidders with zero digital footprint, the Shrimps are swimming in waters that would make even seasoned sports business professionals question the system.

When clubs become so financially desperate they'll entertain bids from virtually anyone, it exposes fundamental flaws in football's ownership oversight that the proposed Independent Football Regulator aims to fix.

Quick Reads

Financial Reality Check: Morecambe's cash flow crisis under Bond Group Investments shows how quickly lower league clubs can hit the rocks

The Punjab Warriors Flop: A 2023 deal with Sarbjot Johal fell through after failing EFL's Owners' Test, highlighting due diligence gaps

Ghost Buyer Alert: New bidder Johnny Cato has virtually no traceable business history. yet his bid is progressing

Regulatory Gaps: Current EFL ownership rules focus on past failures, not future suitability

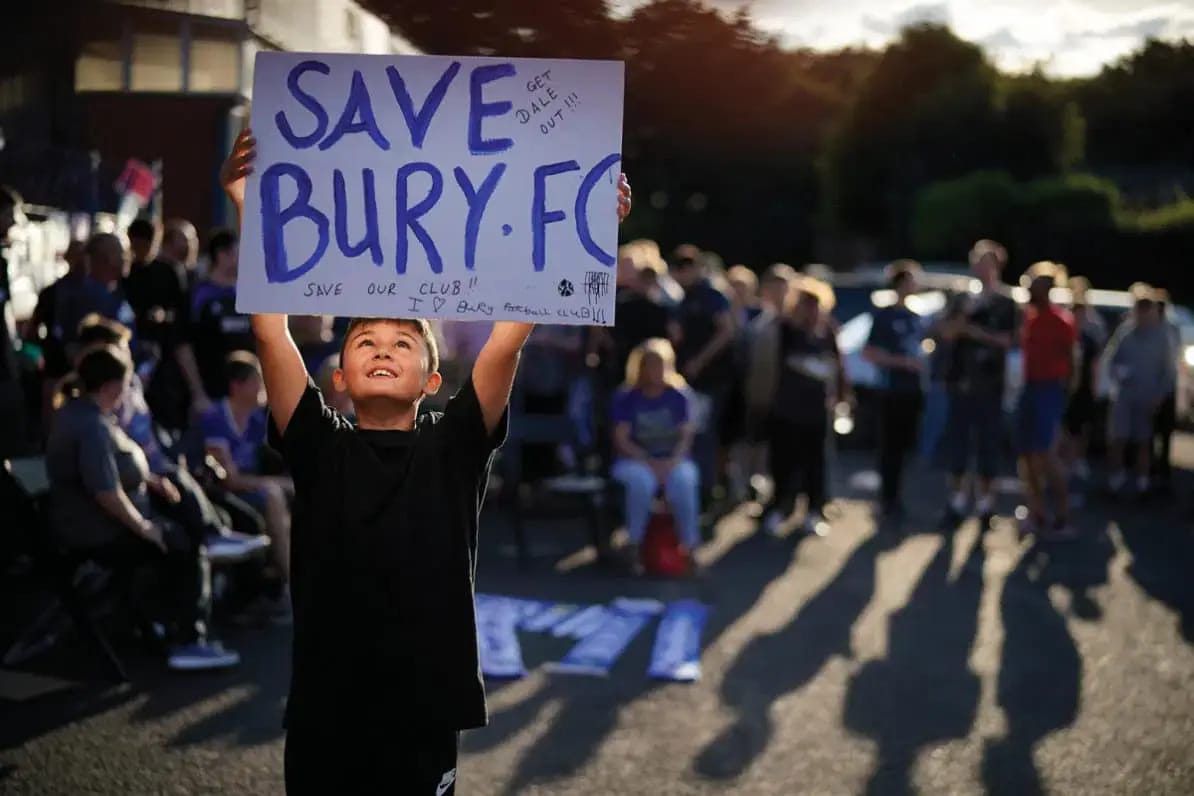

Historical Parallel: Echoes of Bury FC's collapse and Portsmouth's revolving door of questionable owners

The Beautiful Game's Ugly Business

Hello, Hi Visionaries!

Right, let's talk about something that makes my competitive spirit absolutely mental: watching football clubs get passed around like unwanted Christmas presents whilst the people who actually care. Fans, players, communities get left holding the bag.

Morecambe FC, those loveable Shrimps from Lancashire, are currently serving up a case study in everything that's wonky about football ownership. And mate, it's a proper mess.

When Money Talks, But Whispers Lies

Under Jason Whittingham's Bond Group Investments, Morecambe were living paycheque to paycheque and I mean that literally. Delayed wages, late tax bills, everything that represents a struggling club was happening at Moorcombe. Sound familiar? It should, because we've seen this before.

Remember Bury FC? Gone. Macclesfield Town? Expelled. These aren't just statistics, they're cautionary reminders about what happens when financial sustainability isn’t part of a clubs strategy.

The brutal truth is that lower league football operates on margins thinner than Troy Deeney’s patience. Gate receipts barely cover the tea and biscuits, commercial deals are harder to find than a quiet moment at Old Trafford, and TV money? What TV money?

Enter the Mystery Buyers

Here's where we start to see some mud in the waters. Sarbjot Johal was initially the preferred bidder in 2003. Johal's "private equity empire"? Turns out it was basically a shelf company you could've bought online for a few hundred quid. His supposedly billion-pound drinks business? A collection of small-time operations that wouldn't fill a corner shop, let alone fund a football club.

The EFL's "source and sufficiency of funds" test isn't just bureaucratic box-ticking. It's designed to weed out exactly these situations. Can you prove you have the money? Can you prove where it came from? Can you prove it's legitimate?

Spoiler alert: Johal couldn't. The bid eventually died a quiet death, leaving Morecambe back where they started. Desperate for investment but now with added trust issues.

A new bid comes from a group called the Punjab Warriors is accpeted. Red flags for me are that this group doesn’t appear to have a history of investing in sports. In fact there’s no track record of any successful investments. however, that doesn’t mean there is anything suspicious.

Another twist in the story happens when along comes a chap called Johnny Cato with a bid that's apparently progressing. right under the nose of and accepted bid of the Punjab Warriors group.

I work in Risk Management and I had to get my risk assessment skills to use. Johnny Cato? He's got the digital footprint of a ghost. No LinkedIn, no business records, no press mentions. It's like he materialised out of thin air with a chequebook.

Compare that to legitimate sports investors like Todd Boehly at Chelsea or Fenway Sports Group at Liverpool. These groups have transparent track records, public business histories, and clear funding sources. They're not operating in the shadows.

Historical Context: We've Been Here Before

This isn't Morecambe's first rodeo with questionable ownership interest. The Punjab Warriors saga from 2023 should have been a wake up call. Sarbjot Johal's group promised the world but couldn't satisfy basic EFL requirements.

It reminds me of Portsmouth's nightmare years between 2009-2013, when they had more owners than Premier League points. Each new buyer promised salvation, but the club kept sinking deeper into administration. The fans suffered, the players suffered, and the community lost a piece of its identity.

The Business Reality

From a sports business perspective, this is where things get concerning:

Due Diligence Failures: How are clubs so desperate that they'll entertain bids from people with no verifiable business background?

Market Vulnerability: Lower leagues are prime targets for money laundering and financial crime precisely because oversight is weaker and desperation is higher.

Community Asset Risk: These aren't just businesses. They're cultural institutions. When they fail, entire communities lose something irreplaceable.

The Solution: Regulatory Reform

The proposed Independent Football Regulator isn't just bureaucratic box-ticking. It's essential protection for the game we love. Here's what it would bring:

Enhanced Due Diligence: Proper background checks that go beyond criminal records to assess financial capability and business ethics.

Transparency Requirements: Forcing potential owners to disclose funding sources and business plans.

Early Warning Systems: Identifying financial distress before clubs reach crisis point.

Community Protection: Treating clubs as community assets, not just commercial ventures.

Industry Takeaways for Sports Business Professionals

Risk Assessment Evolution: Traditional due diligence in sports M&A needs updating for modern financial crime patterns

Regulatory Anticipation: Businesses operating in football should prepare for increased oversight and transparency requirement

Community Stakeholder Importance: Brands and investors ignoring community impact do so at their own reputational risk

Lower League Opportunities: While riskier, proper investment in lower leagues can yield significant returns as regulatory clarity improves

The Competitive Edge Perspective

As someone who believes in playing by the rules and earning your victories, this situation frustrates me. You wouldn't let just anyone coach your team, manage your training, or handle your contracts. So why should football clubs, the heartbeat of their communities, be any different?

The best athletes surround themselves with trustworthy, qualified people who share their vision and values. Football clubs deserve the same standard.

Looking Forward

Morecambe's story isn't finished. Whether Johnny Cato proves to be a legitimate saviour or another false dawn remains to be seen. But regardless of this particular outcome, the systemic issues remain.

The Independent Football Regulator can't come soon enough. Until then, clubs like Morecambe will continue swimming in dangerous waters, hoping the next buyer isn't a shark in disguise.