Summary:

LIV Golf's £2 billion Saudi backed disruption has forced the entire sport to rethink its business model. From 72-hole traditions to 54-hole entertainment, from individual contractors to franchise equity holders. While viewership stagnates and audiences age (UK golf fans average 52+), the sport is experimenting with everything from YouTube streams to gambling integration.

Quick Reads

The Numbers Game: UK golf fans average 52+ years old; PGA Tour viewership dropped from 3.6M to 2M for non-majors since 2013

LIV's War Chest: £160M to Phil Mickelson, £120M to Dustin Johnson—but the real innovation is franchise equity ownership

Format Revolution: 54-hole tournaments with no cuts, team-based competition, and direct-to-consumer streaming

The IPL Playbook: Cricket's T20 format boosted global cricket revenue from £2.5B to £6B in a decade—golf is following suit

Merger Reality: 2023 PGA-LIV merger talks through "PGA Tour Enterprises" show both sides recognise hybrid future

Regional Winners: Topgolf UK revenue up 38% YoY; emerging markets using golf for soft power diplomacy

Tech Disruption: VR golf, smart simulators, and influencer content (Good Good Golf, Rick Shiels) driving new audiences

Business Opportunities: Franchise models, simulator chains, betting integration, and lifestyle branding represent growth areas

The Opening Drive

Picture this: You're standing on the first tee at St Andrews in 1960. The crowd is hushed, respectful. Maybe 200 people deep. Fast-forward to today, and Phil Mickelson is pocketing £160 million just to switch leagues whilst simultaneously breaking the internet.

Welcome to golf's midlife crisis and it's absolutely fascinating.

As someone who spends hours dissecting what makes sports tick (and what makes them profitable), golf's current transformation feels like watching a heavyweight title fight in slow motion. In one corner: tradition, patience, and the gentle thwack of leather on willow. In the other: Saudi billions, 54-hole sprints, and YouTube streams.

The Problem: When Tradition Meets TikTok

Let's be brutally honest here. Golf has a Gen Z problem that makes cricket's look manageable.

The numbers don't lie: the average UK golf fan is now 52+, and Sky Sports golf viewership has been flatlining harder than my putting game on Sunday mornings. Meanwhile, across the pond, PGA Tour audiences have dropped from 3.6 million viewers in 2013 to barely 2 million for non-major events.

It's like watching your favourite band refuse to leave the 1980s whilst everyone else discovers Spotify.

But here's where it gets interesting—and where every sports business professional should pay attention. This isn't just golf's problem. It's a masterclass in what happens when heritage sports meet modern attention spans.

Remember when Formula 1 was considered boring? Before Netflix's "Drive to Survive" turned it into must-watch television? That transformation didn't happen by accident—it happened because F1 recognised that stories sell better than statistics.

Enter the Disruptor: LIV Golf's £2 Billion Gamble

If golf was a startup pitch, LIV Golf would be the venture capital fund that walked in with a briefcase full of Saudi petrodollars and said, "Let's rebuild this from scratch."

The numbers are staggering:

£160 million to Phil Mickelson

£120 million to Dustin Johnson

£100 million to Bryson DeChambeau

But here's the genius move that most people missed: LIV didn't just buy players. They created a franchise system. Suddenly, golfers aren't just individual contractors grinding for prize money; they're equity holders in teams with names like "4Aces GC" and "Crushers GC."

Sound familiar? It should. It's the IPL playbook applied to golf.

Think about it: Twenty years ago, cricket was facing similar challenges. Test matches were losing viewers, the format felt antiquated, and suddenly the Indian Premier League exploded onto the scene with shorter formats, franchise ownership, and bollywood-level entertainment.

The result? Cricket's global revenue jumped from £2.5 billion to over £6 billion in a decade.

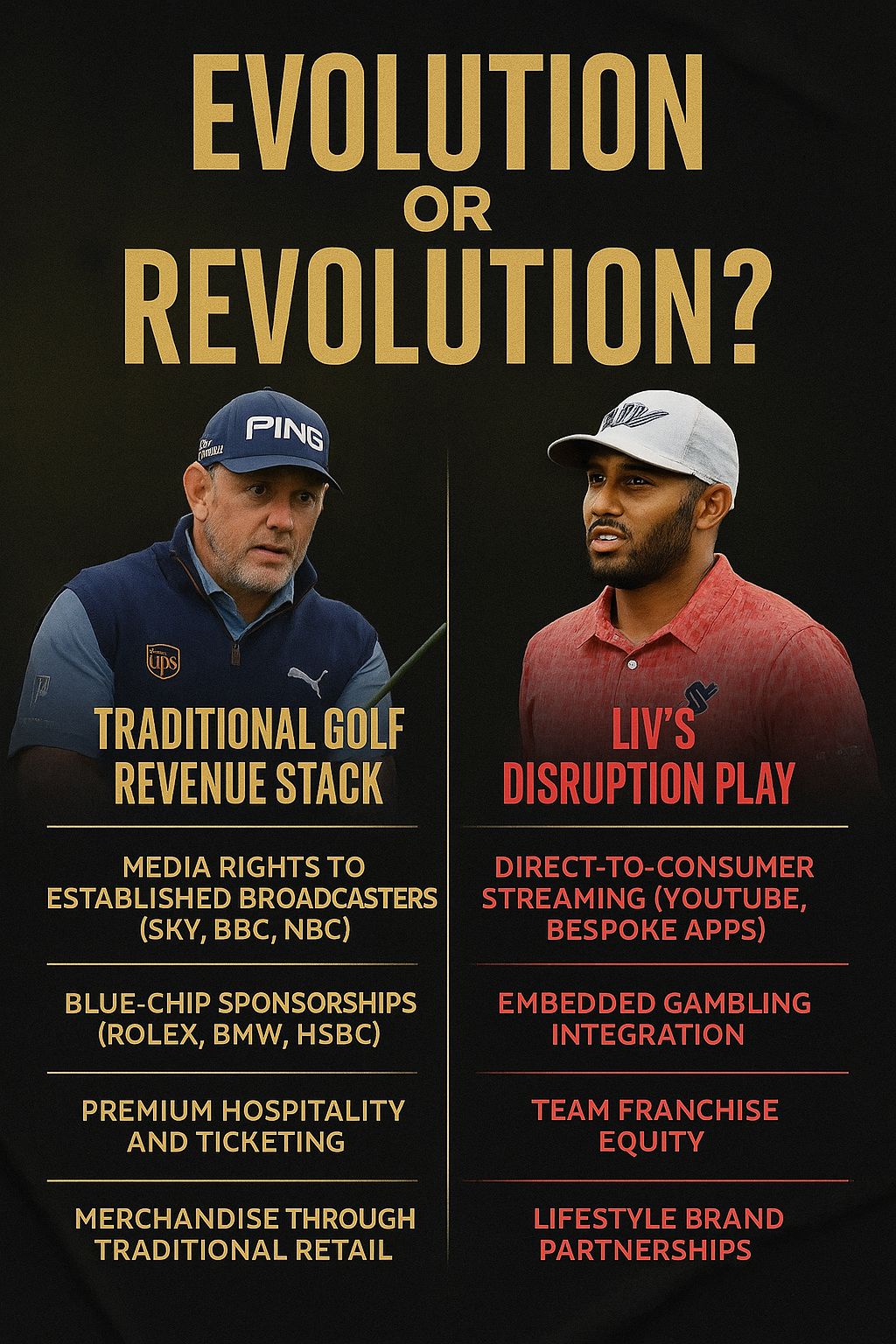

The Business Model Breakdown: Old Guard vs New Money

Here's where things get properly interesting for anyone working in sports business:

Traditional Golf Revenue Stack:

Media rights to established broadcasters (Sky, BBC, NBC)

Blue-chip sponsorships (Rolex, BMW, HSBC)

Premium hospitality and ticketing

Merchandise through traditional retail

LIV's Disruption Play:

Direct-to-consumer streaming (YouTube, bespoke apps)

Embedded gambling integration

Team franchise equity

Lifestyle brand partnerships

The traditional model is Manchester United circa 2005. The LIV model is Manchester City with unlimited resources and a complete disregard for "how things have always been done."

But here's the plot twist: In 2023, both sides blinked. The PGA Tour and LIV announced merger talks through "PGA Tour Enterprises" essentially admitting that the future lies somewhere in the middle.

Regional Playbook: How Geography Shapes Strategy

United Kingdom: Heritage vs Innovation

Home to The Open Championship (golf's oldest major)

Viewership spikes only for majors and Ryder Cup

Traditional clubs struggling with ageing memberships

But Topgolf revenue up 38% year-on-year—indoor golf is booming

United States: The Revenue Engine

Still golf's biggest market by miles

Amazon and Netflix exploring unscripted golf content

Betting partnerships gaining serious traction (PGA + DraftKings)

Emerging Markets: The Wild Card

Saudi Arabia hosting LIV events as part of Vision 2030

African nations seeing youth participation rise through digital simulators

Golf becoming a soft power tool for Middle Eastern nations

The Competition: Learning From Other Sports

Every sport faces the attention economy battle, but some are winning spectacularly:

Tennis: Maintains individual star power whilst adapting formats (shorter sets, faster courts)

Formula 1: Transformed from niche to mainstream through storytelling and streaming strategy

Pickleball: The fastest-growing sport in America by simply being more accessible than tennis

Golf's challenge? It's simultaneously competing with all of these whilst trying to maintain its unique selling proposition: the blend of individual skill, natural beauty, and aspirational lifestyle.

Solutions in Play: The Hybrid Future

Smart money is betting on convergence rather than disruption. Here's what's working:

Technology Integration: Smart simulators and VR golf expanding accessibility beyond traditional courses

Content Revolution: Influencers like Good Good Golf and Rick Shiels creating TikTok-native fanbases

Lifestyle Branding: Golf fashion brands (Malbon, Bogey Boys) making the sport culturally relevant again

Community Investment: R&A and UK councils co-investing in municipal course upgrades

The winning formula seems to be: Keep the tradition, modernise the delivery, and never underestimate the power of good storytelling.

Business Takeaways: What This Means for You

Whether you're advising brands, building startups, or managing sports properties, golf's transformation offers crucial insights:

For Brand Managers: Hybrid formats and influencer-driven content platforms are where the growth is happening

For Entrepreneurs: Tech solutions for scoring, coaching, and fan engagement are massively underserved markets

For Investors: Franchise-based teams and simulator golf chains represent early-stage opportunities

For Media Professionals: Bundle live rights with behind-the-scenes content.

For Venue Operators: Monetise off-peak hours with virtual events and youth programmes

The Final Putt

Golf's revolution isn't just about Saudi money or shorter tournaments. It's about a heritage sport learning to compete in the attention economy without losing its soul.

The parallels to other industries are striking. Just as streaming disrupted traditional television, and fintech challenged traditional banking, LIV Golf has forced the entire sport to question its assumptions about value creation and audience engagement.

The ultimate winner won't be determined by who has the deepest pockets. It'll be whoever builds the better long-term business model whilst maintaining the sport's unique appeal.

Golf has always been a game of patience. Ironically, the sport's future depends on its ability to adapt quickly.